Streaming is about to learn what the printed web learned 20 years ago.

Streaming is about to learn what the printed web learned 20 years ago.

In a world of unlimited content, the gating factor for your audience is time.

There’s a corollary. Don’t depend on ads to make up for this. There’s just too much inventory.

I have a bad tendency to be early to things. I screamed about the dot-com bubble in 1997. I’ve been yammering about the coming streaming crash since 2019.

But now it’s here. First Netflix (NFLX) fell from grace. Then Disney (DIS) did the same. The Cloud Czars are worth half what they were now that you can get paid for having money. When interest rates were 2%, a price to earnings multiple of 45 looked OK. With money at 5% you need to be below 20 to be competitive.

The big pain is further down the league in what I call the streaming “relegation zone.” These are companies that don’t own clouds, and that have lost their older connection to customers as they cut the cord and the Internet replaced cable.

The big pain is further down the league in what I call the streaming “relegation zone.” These are companies that don’t own clouds, and that have lost their older connection to customers as they cut the cord and the Internet replaced cable.

Any of these companies can now be bought by the market leaders for a fraction of their 2021 value. Regulators may resist, but when the alternative is bankruptcy they always give in.

Start with AMC Networks (AMCX). What was once the home of Mad Men failed to gain traction in streaming. The company can be had for “just” $1 billion. Its market cap is $826 million. The CEO admits he’s circling the drain. For an outfit like Netflix, it’s a snipping. No one in Washington will say a word.

I wrote about Roku (ROKU) just the other day and was shocked by what I found. This was a $35 billion outfit a year ago. Now they’re worth under $8 billion. You can control hardware with its stick and get a free streamer that (for now) is making money. Hello, Walmart (WMT)! Shopping?

Next up is Paramount Global (PARA). They spent a decade waiting for Sumner Redstone to die, and now they’re dying. The home of CBS, Viacom, and a second-rate streamer is now worth just $14 billion. Wall Street acts like they’re viable, but they’re not. Their TV and cable operations are mostly game shows, talk shows, and reality programs. It costs big money to make big entertainment. Their cash is drying up, their debt is crippling. Amazon might have trouble getting approval for this deal, but why? Would it make them dominant in anything, when compared with Netflix, Disney, Apple (AAPL), and Google (GOOGL)?

Next up is Paramount Global (PARA). They spent a decade waiting for Sumner Redstone to die, and now they’re dying. The home of CBS, Viacom, and a second-rate streamer is now worth just $14 billion. Wall Street acts like they’re viable, but they’re not. Their TV and cable operations are mostly game shows, talk shows, and reality programs. It costs big money to make big entertainment. Their cash is drying up, their debt is crippling. Amazon might have trouble getting approval for this deal, but why? Would it make them dominant in anything, when compared with Netflix, Disney, Apple (AAPL), and Google (GOOGL)?

Take Warner Discovery (WBD). Please. They’re worth under $27 billion. The home of CNN and HBO is cutting budgets and cutting staff. It’s like a dowager selling the family silver and spreading out what’s left of the furniture while she goes around in gowns and paste. There’s also no “founders’ stock” to keep someone else from making an offer, which is why it’s been sold and re-sold, in whole or in parts, multiple times since Ted Turner’s heyday. I’m thinking Disney might make a run.

Comcast (CMCSA) must be desperate for one of these bargains. They’re at the bottom of the top tier with a market cap of $153 billion. They own NBC, its cable offshoots, and Universal Studios. They control the cable market and, thus, the Internet access market. But they need to do what AT&T did, ditch the content. Find a buyer, like Google, then turn all your cable frequencies into two-way Internet. Google might buy it that way. Apple might buy the whole thing.

Comcast (CMCSA) must be desperate for one of these bargains. They’re at the bottom of the top tier with a market cap of $153 billion. They own NBC, its cable offshoots, and Universal Studios. They control the cable market and, thus, the Internet access market. But they need to do what AT&T did, ditch the content. Find a buyer, like Google, then turn all your cable frequencies into two-way Internet. Google might buy it that way. Apple might buy the whole thing.

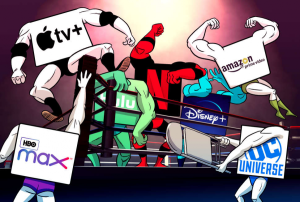

What’s left, as I said at the outset, will mainly be the Cloud Czars. Apple, Google, and Amazon all control the cloud networks needed for streaming to happen. They’re scaled to run this business. Netflix and Disney will still be around for a while, but they’ll be gobbled in time.

This is the way the business world works. You see things start, you see things grow, then they stop growing and consolidate. It’s as inevitable as the leaves falling from the trees. It’s very likely to be the big business story of 2023.