Despite some stunning investment losses, I’m enjoying the latest tech recession.

Despite some stunning investment losses, I’m enjoying the latest tech recession.

No one likes a recession, but sometimes it’s like spring cleaning, necessary to clear the excess. There were a lot of zombie technologies, zombie companies and zombie assumptions that have been overrun since the Fed decided that money should cost money and there should be less of it around.

Web3, the metaverse, and crypto were all fake from the jump. Advocates for streaming and podcasting didn’t understand that the gating factor is time, not money. A lot of companies were selling themselves based solely on sales growth, ignoring the need for profit.

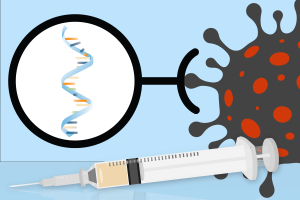

This means there’s now opportunity, in the form of talent, for new ideas that will power the economy forward. The main trends I described in 2019 – the end of oil, the Machine Internet, and DNA as a Programming Language – they’re still on. But there’s a lot more, too.

The question is always what you can do to help. There are a lot of great open source projects looking for your time, and from them you’re likely to find your next career. The model, of open standards and a high, rising floor for everyone to develop on, will find applications in many new fields.

The question is always what you can do to help. There are a lot of great open source projects looking for your time, and from them you’re likely to find your next career. The model, of open standards and a high, rising floor for everyone to develop on, will find applications in many new fields.

I believe that cloud infrastructure is tremendously undervalued right now. Analysts aren’t valuing the data centers of Apple, Microsoft, Amazon, Google or even Meta properly. Owning a network of scaled data centers means everyone must rent from you. Even if you’re not renting out capacity, your costs are dramatically lower than competitors’. It’s in these centers that the future will be built.

Cheaper, more plentiful chips means you can turn any process into a system at just the cost of software. Building off open source, and open standards, lowers the cost still further. The failure of home-based services, and of voice interfaces like Alexa, means the first successes will come in systems owned by single companies. Factories. Hospitals. Distribution centers. Farms. Cities. Drive down costs here and you will get paid.

The metaverse is a lemon. Make lemonade. The obvious application is gaming. But what about repair? What about training? What about education? Write the course, or the manual, make it into software loaded onto glasses that may or may not interact with the real world, and you can scale the value.

The metaverse is a lemon. Make lemonade. The obvious application is gaming. But what about repair? What about training? What about education? Write the course, or the manual, make it into software loaded onto glasses that may or may not interact with the real world, and you can scale the value.

There are huge industries that until now have fought successful battles against technology. Education is one. Health is another. Technology can’t afford to lose those battles anymore. It won’t.

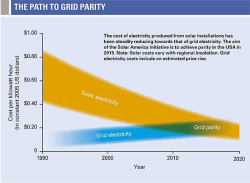

The coming years will also see the creation of entirely new industries that didn’t exist before, driven to the fore by climate change. This may be how Europe’s economy comes back, because they already lead in food, and they have bigger incentives to change in energy.

At 67, I can’t promise to be around the next time we have a recession opportunity like this one. Savor it. Let your imagination run free. Create something new.