Markets will turn when they’re convinced the Federal Reserve is easing up in its war against inflation.

Markets will turn when they’re convinced the Federal Reserve is easing up in its war against inflation.

This could come at any time. Home prices are starting to fall. Industrial input prices have been falling for months. The strong dollar means we’re exporting inflation and importing deflation. Technology continues to cut costs, including labor costs.

Once the tide has turned, TV will be all over rising stock prices. The Cloud Czars will rise first, along with consumer stocks. Even banks might finally get a bid.

But the real gains will come in bonds.

That’s a problem. Because bond markets are far less liquid than stock markets. It costs big money to research bond markets, even in a cursory manner. It’s difficult to execute a purchase, even of a government bond. Most investors don’t understand bond markets. Others fear the fact that bonds have been falling in value right along with stocks.

But here’s what happens when money costs money but then starts costing less money.

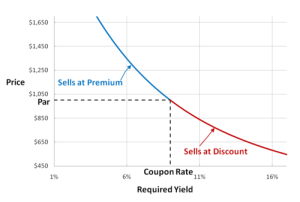

Say you bought a 5% bond at the market peak. The value of that bond is 100, or par. When the price of money falls to 4%, you’re up 25%. When it’s at 3%, you’re up 60%, because 3 is just 2/3rds of 5. Meanwhile, the quality of that bond is rising because a rising economy makes payment more certain. Even if the bond is “called,” or paid off early, you’re scoring a fat gain.

Say you bought a 5% bond at the market peak. The value of that bond is 100, or par. When the price of money falls to 4%, you’re up 25%. When it’s at 3%, you’re up 60%, because 3 is just 2/3rds of 5. Meanwhile, the quality of that bond is rising because a rising economy makes payment more certain. Even if the bond is “called,” or paid off early, you’re scoring a fat gain.

It’s the professionals who will score these fat gains, along with their rich clients. Small investors won’t because small investors are mostly locked out. For example. Did you know that Coca-Cola offered 70 year bonds paying almost 7.5% last year? If you could get some of those when the market turns, you’re looking at big gains. Think you can? Think you can sell them after you get them?

Small investors are told to buy bond funds. These should rally once interest rates fall. But they won’t rise nearly as much as the bonds themselves because the funds will have to keep buying lower rate bonds and were doing so all the way up.

Rich people are very angry right now. They’re angry at the Fed for raising interest rates. They’re angry about this year’s trading losses. They’re screaming that it all needs to be taken out on you, in the form of lower wages, higher taxes, and real suffering.

But when the bond market turns, they won’t say a word.