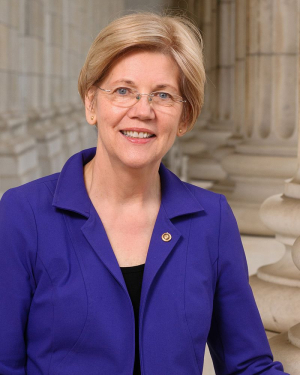

Like a lot of people, I admire Sen. Elizabeth Warren of Massachusetts, or as the great Charlie Pierce calls her Senator Professor Warren (SPW).

Like a lot of people, I admire Sen. Elizabeth Warren of Massachusetts, or as the great Charlie Pierce calls her Senator Professor Warren (SPW).

But, again like most people, I can’t vote for her for President.

The reason, in my case, is Warren’s attitude to the Cloud Czars. Warren is staking a big part of her candidacy on running against them.

Let’s set aside, for a moment, the fact that the Czars – Microsoft, Apple, Amazon, Google and Facebook – now command a combined market cap of nearly $4.5 TRILLION. Never mind that they dominate the business world, or that democracy always follows the Golden Rule – he who has the gold makes the rules. Democrats aren’t going to win the White House over the objection of the Czars and the bulk of the technology industry.

My beef here has to do with her proposal to break up the Czars, starting with Amazon.

Her argument against Amazon is that the company can see which brands people are buying, then put an Amazon version into the market and wipe out the other seller. It’s like she never heard of store brands.

Store brands have been a feature of American retailing practically since brands. Kroger does it with food. Target does it with clothes. Walmart does it with both. Walmart calls their store brands “Great Value.”

These stores decide what products to store-brand, and even how they will be designed, based on data about what brands are selling. This gives consumers lower-priced alternatives to the brands. It’s competition. It’s what made Seventh Avenue an apparel hub right into the 1960s, even while designers called what they were producing “knock-offs.”

These stores decide what products to store-brand, and even how they will be designed, based on data about what brands are selling. This gives consumers lower-priced alternatives to the brands. It’s competition. It’s what made Seventh Avenue an apparel hub right into the 1960s, even while designers called what they were producing “knock-offs.”

That’s precisely what Amazon is doing. It’s making knock-offs. Nothing more, nothing less. Might as well go back in time and put the Maisels out of business.

What Warren is complaining about is that half of what Amazon sells in its store isn’t from Amazon. They’re not taking most of their own inventory risk. That risk is being borne by third parties. It’s small business. Hundreds of thousands of small merchants buy products, or make products, making them available on Amazon, with Amazon handling the warehousing, picking, shipping, and even transaction costs.

Thousands of merchants are making a living at this. About 20% have built million-dollar businesses. Many of these merchants also sell through their own sites and other third parties, like eBay. Walmart is now trying to recruit them, but only because Amazon is making so much money serving them.

Thousands of merchants are making a living at this. About 20% have built million-dollar businesses. Many of these merchants also sell through their own sites and other third parties, like eBay. Walmart is now trying to recruit them, but only because Amazon is making so much money serving them.

Amazon’s low-cost infrastructure is the only reason small merchants can compete online against Walmart. Amazon has, by itself, changed the structure of retail. Retailing is no longer the monopoly Walmart threatened to make it 25 years ago, when it destroyed small downtowns and pushed everything out to its superstores. Yes, many of these merchants are afraid that Amazon may compete more directly with them. Maybe they need a little help, when Amazon steps on them. But generally they can handle it. They are handling it.

Amazon itself is made possible by its cloud. Amazon Web Services was built to serve the interests of Amazon’s store. Amazon Web Services itself is, like its Merchant Services, a way to share the cost, and benefits, of cloud with other people. This, too, has revolutionized how business is conducted. This is the revolution.

Amazon itself is made possible by its cloud. Amazon Web Services was built to serve the interests of Amazon’s store. Amazon Web Services itself is, like its Merchant Services, a way to share the cost, and benefits, of cloud with other people. This, too, has revolutionized how business is conducted. This is the revolution.

Let’s talk about those clouds and how they came to be. Back when the web was spun, and monopolists like Walmart dominated the world, communications was controlled by AT&T. AT&T had every opportunity to invest in new computing infrastructure. AT&T could have built the cloud.

But AT&T, like any company subject to strict government regulation (and benefitting from its subsidies) refused to act. AT&T preferred its 5% annual dividend to investing in its business. Had we waited for AT&T to develop the cloud we’d still be waiting. The cloud would be speaking Chinese, as in Alibaba.

The clouds were developed with risk capital. Private companies took big risks, because this is expensive infrastructure. As I wrote early in this decade a capital budget of $1 billion per quarter is just an ante into the game. Google and Amazon started it, but Facebook began developing its cloud before it had enough cash flow to support it. These companies risked everything to build their cloud networks.

The clouds were developed with risk capital. Private companies took big risks, because this is expensive infrastructure. As I wrote early in this decade a capital budget of $1 billion per quarter is just an ante into the game. Google and Amazon started it, but Facebook began developing its cloud before it had enough cash flow to support it. These companies risked everything to build their cloud networks.

Apple and Microsoft, a generation older than these companies, did finally step up to the plate of cloud. Microsoft didn’t commit until 2014, when Satya Nadella became CEO. Apple, under Tim Cook, waited even longer, and is still a big user of Amazon’s cloud as it builds out its own services.

The point is that the clouds are capitalism in action. For America to retain its technology leadership, for us to have a shot at the next cloud-like opportunity, we need the freedom raw capitalism provides. We need its risk. We need its start-ups. We need people to think of things that haven’t been done before, and to do them. The great majority of these people will fail. A few will succeed. A very few will succeed spectacularly.

There is a very real question about power here, and how the Cloud Czars wield it. They have created a new medium. It’s bigger, more powerful and more global than all other media combined.

Because they fear “common carrier” regulation, the kind of deep regulation that turned AT&T into a slow-moving, lethargic monopolist, the anti-trust regime that made IBM an also-ran and nearly ran Microsoft off the road, the Cloud Czars have not taken full responsibility for this medium.

Because they fear “common carrier” regulation, the kind of deep regulation that turned AT&T into a slow-moving, lethargic monopolist, the anti-trust regime that made IBM an also-ran and nearly ran Microsoft off the road, the Cloud Czars have not taken full responsibility for this medium.

We are all paying a price for that. Trump is part of that price. Trump is also the enemy of the Cloud Czars. He fights for the interests of the oil companies, and the manufacturers, the true despoilers of the Earth. Compared with Exxon, the carbon footprint of Google, even Amazon, is negligible. They’re the solution, not the problem, along with the thousands of companies in hardware, software, networking and services that have risen in their wake.

The Czars are now awake to the political reality. That’s why Google closed Google+. It’s why Microsoft is a laggard in consumer services. It’s the reason Apple insists on being a “walled garden,” strictly controlling what can and can’t be sold through its iTunes store, and taking an enormous 30% cut off the top. It’s why Facebook is now trying to transform itself, into a global communications company.

This is only possible because of the light regulation placed on the Internet when the Web was first spun. The risk-taking, the creation of new industries and media, was only possible because people acted first, outside government. The Cloud Czars will step up to control what they have created, in their own interest. Twitter is leading the way in this.

But if you break up the Clouds, all that will be left will be AT&T, and the government-run PTTs that stifled global growth and liberty for decades before the Web was spun. In the end, the Cloud Czars are on the side of liberty. Separating the infrastructure from the services it creates would destroy that.

Cool

Cool

I can only hope for the best But break the clouds is destroying the world Amazing

I can only hope for the best But break the clouds is destroying the world Amazing