To read the people on my Twitter feed, 2017 has been the worst year ever.

To read the people on my Twitter feed, 2017 has been the worst year ever.

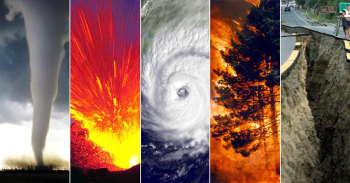

If someone you love has been killed by a drone, or a cop, if their home was flooded by Harvey or Irma, if your community was destroyed by Maria, if your life was ruined by the California wildfires, then, yes, this has been a horrible, terrible, no good and very, very bad year.

But despite Trump, despite everything, this has been (so far) a pretty good year. For the economy. That matters. A lot. When you have a job and money in your pocket, you’re going to forgive a lot of bullshit, and focus on other things.

The U.S. economy continues to grow, and the stock market continues to go up, thanks to the cloud-and-device revolution. That revolution has sparked growth around the world, especially in India, in Southeast Asia, and in Africa, as the cost of getting goods to market, and through the market, keep going down. We are on the cusp of seeing the next stage in this evolution, as blockchain automates contracts, financial agreements, transactions, and trust.

The U.S. economy continues to grow, and the stock market continues to go up, thanks to the cloud-and-device revolution. That revolution has sparked growth around the world, especially in India, in Southeast Asia, and in Africa, as the cost of getting goods to market, and through the market, keep going down. We are on the cusp of seeing the next stage in this evolution, as blockchain automates contracts, financial agreements, transactions, and trust.

Technology is naturally deflationary. It’s amazing how many so-called financial analysts don’t get that. They express shock over the “lack of inflation,” which keeps interest rates low, and issue dire warnings about what will happen if it continues.

It will continue.

All this was launched, endorsed, and supported by the Obama Administration. Trump’s good fortune is that he has not (yet) been able to screw it up. But he will keep trying. A tax cut that hands more trillions to billionaires rather than creating new things to invest in, is likely to be the final straw for growth, and the stock market.

If you think Trump’s unpopular now, imagine what happens when the stock of Amazon and Facebook roll over, when profits in trading books turn to losses, and when financial instruments of all kinds take a 50% haircut. Or more.

But recessions are still caused by excess. Excess war spending in 1991. Excess speculation in 2000. Excess bankruptcy in 2008. These recessions have been spread so far apart in time that there is no institutional memory of them, at least enough that might prevent them. You look at the faces staring at screens in all three crashes. They’re the same age. Which means they’re different people. “This has never happened before,” they’re thinking. “This can’t be happening.” Oh yes, it’s happening.

The next crash isn’t going to start in New York, anyway. It is already happening, as unicorn values fall to Earth. It’s going to accelerate when so many of the unregulated Initial Coin Offerings being sold to the gullible turn out to be hot air. Blockchain is the Internet, but Bitcoin is the dot-com bubble of our time, and that bubble is doomed to bust.

It’s then that the shit hits the fan.

You think you hate Trump now? Imagine what happens when the Dow goes to four figures again. It can happen. That’s a natural result of crashes.

The collapse will be sudden, the recovery could leave Wall Street behind. Blockchain, the automation of trust following the automation of markets made possible in this decade, doesn’t need those institutions, those traders and speculators. Already, machine algorithms are putting stock picking mutual funds out of business, thanks to lower costs. I’m glad my wife has a 401K rather than a defined benefit plan – transaction processors and banks are going to have as hard a time in the next decade as oil companies are having now.

It doesn’t describe their business supporters, either, whether on Wall Street or in the resource industries. To get out of this we need a government that is not just willing but able to move, quickly, supporting change while at the same time dealing with its negative side-effects, the lives and fortunes taken out.

This is the key lesson of American history. It’s always the economy, stupid. And the stupid economy. That’s what drives political change. It’s the search for progress, which is at the heart of business and of the word progressive. If we don’t lose that, we’ll get through this. If we do, someone else will take over the world.