Think of this as Volume 18, Number 3 of the newsletter I have written weekly since March, 1997. Enjoy.

I recently did a piece for TheStreet.com on Austrian economics and, out of modesty, I didn't offer my full view of the matter, because I'm a tech writer.

I recently did a piece for TheStreet.com on Austrian economics and, out of modesty, I didn't offer my full view of the matter, because I'm a tech writer.

My view is that Austrian economics, like Karl Marx' communism, is faith-based economics. It ignores economic evidence, its acolytes spending all their time rejecting contrary facts.

They explicitly reject the notion that government can weigh evidence of economic strength or weakness and do anything about it. Thus Austrian economics can never fail. It can only be failed by those too weak to apply it rigorously enough.

Austrian economics stands alongside climate denialism and religious millenialism as one of three pillars of the modern conservative movement. This is what makes conservatism a clear and present danger to democracy in our time. It's at the heart of our present crisis.

That's because democracy thrives only in an atmosphere of real give-and-take, where facts are agreed-upon and we engage in a rigorous discussion on dealing with those facts. If people don't accept facts you're left with what the Middle East and Africa face, a dictatorship by either religious oligarchs or financial ones, the latter allied to corrupt militarists who feel forced to stand-in between the people and the modern world in order to maintain their comfortable lifestyles.

In America, it's financial oligarchs who maintain the fictions of Austrianism, of climate denialism, and of religious millenialism. If a bus took out Charles and David Koch tomorrow, and if their heirs decided to withdraw the family from politics, the whole edifice might be crippled, possibly beyond repair. Unless the Wal-Mart heirs chose to stand in the breach. (Note that both the Koch money and Walton money is second-generation money – none of these people did a damn thing to deserve a dime of what they have.)

Having switched from a tech beat to a financial one almost three years ago, I'm having to deal a lot with the Austrians these days. They're Clueless, but since they never have to accept a Clue their cluelessness is evergreen.

Foremost among them is David Stockman. The former “boy wonder” head of Reagan's Office of Management and Budget, the man who first called out “trickle down” economics, has since spent a very comfortable life in Connecticut, sucking up what I can only call Wall Street Welfare. He's paid outrageous sums for no real work, and given access to no-lose deals he has no business getting into.

Foremost among them is David Stockman. The former “boy wonder” head of Reagan's Office of Management and Budget, the man who first called out “trickle down” economics, has since spent a very comfortable life in Connecticut, sucking up what I can only call Wall Street Welfare. He's paid outrageous sums for no real work, and given access to no-lose deals he has no business getting into.

His book, “The Great Deformation: The Corruption of Capitalism in America,” is a summary of the Austrian case against both monetarism, which the manipulation of the money supply Ben Bernanke used to get us out of the Great Recession, and the fiscal theories of John Maynard Keynes, which eventually got us out of the Great Depression.

Keynes held that when demand falls, government should spend money to support it, then run surpluses when times get better. Monetarism holds that government can prevent bubbles by reining in the supply of money, and end recessions by increasing it. Keynesianism is the use of fiscal policy against collapse, monetarism the use of monetary policy against it. Between them, Keynesianism and monetarism give government levers that can be worked to fight panics and keep growth from getting out of hand.

Keynes held that when demand falls, government should spend money to support it, then run surpluses when times get better. Monetarism holds that government can prevent bubbles by reining in the supply of money, and end recessions by increasing it. Keynesianism is the use of fiscal policy against collapse, monetarism the use of monetary policy against it. Between them, Keynesianism and monetarism give government levers that can be worked to fight panics and keep growth from getting out of hand.

It's one of the great ironies of modern economics that monetarism, whose intellectual father was Milton Friedman, was praised to the skies by the Austrians when it was used to limit the supply of money in the 1960s. Then it was “conservative.” The same policy is now derided as “liberal” because Bernanke, who got many of his cues from Friedman's own studies of the Great Depression, applied it as it was meant to be applied starting in 2008.

Austrians, by contrast, reject any government interference in the markets. Stockman calls such interference “statism.”

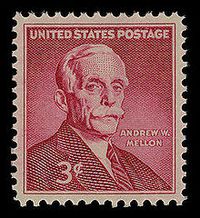

I would describe the Austrian solution as Mellonism, after Andrew Mellon, the Secretary of the Treasury whose policies helped cause and then exacerbate the Great Depression – liquidate the weak, punish the victims, and let a chosen few hold all the economic cards. Those policies of economic royalism failed to hold society together in the 1920s and 1930s – they led directly to fascism and war – which is why the Austrians were exiled in the first place.

I would describe the Austrian solution as Mellonism, after Andrew Mellon, the Secretary of the Treasury whose policies helped cause and then exacerbate the Great Depression – liquidate the weak, punish the victims, and let a chosen few hold all the economic cards. Those policies of economic royalism failed to hold society together in the 1920s and 1930s – they led directly to fascism and war – which is why the Austrians were exiled in the first place.

Austrians believe firmly that “the taper,” the removal of Quantitative Easing (QE) due to start this year, will trigger a complete economic meltdown. They insist that Ben Bernanke's past creation of new money, both in the bailout and in QE, can only be unwound through hyperinflation, which will destroy faith in the currency.

They ignore the fact that the U.S. dollar doesn't just exist as a call on the U.S. economy, but that its use as a “reserve currency” means it has a call on the world economy. There just aren't enough Chinese Yuan, or Japanese Yen, or even European Euros around to do this job of greasing global trade, any more than other languages can replace English as the world's default language.

Thus, the Austrians wanted government do nothing to stop the “money strike” that began in the financial collapse and has only grown in strength since. In response to that paroxysm of economic fear Bernanke handed banks money to make up for losses in the Big Shitpile, bad mortgages turned into gilt-edged bonds through bogus insurance not backed by adequate capital. Instead of investing that money or writing off the bad loans the bankers stuck the cash in their vaults and kept demanding payment on bad loans, where none was possible.

Thus, the Austrians wanted government do nothing to stop the “money strike” that began in the financial collapse and has only grown in strength since. In response to that paroxysm of economic fear Bernanke handed banks money to make up for losses in the Big Shitpile, bad mortgages turned into gilt-edged bonds through bogus insurance not backed by adequate capital. Instead of investing that money or writing off the bad loans the bankers stuck the cash in their vaults and kept demanding payment on bad loans, where none was possible.

Unfortunately “Helicopter Ben” could not drop money on anyone other than bankers because, as a bank regulator, this was beyond his authority. Dropping money on ordinary people means spending, by the government, on things people need and do. Republicans caused this fiscal policy door to shut, then blamed the Administration for the resulting slow growth.

After accepting a stimulus bill that was only half as big as it needed to be, in Keynsian terms, because the outgoing Bush people had said the 4th quarter 2008 economy was contracting at 4%/year instead of the actual 9%/year, Republicans refused to do anything more. The lack of Keynsian stimulus has kept the recovery modest.

Republicans have since taken to harping on “debt, debt debt” they themselves mainly created, with unpaid-for tax cuts to the wealthy, two wars, and a Medicare “drug benefit” that mainly went to big drug companies. The result is a Grecian austerity that has cut the annual deficit by more than half, but at the expense of economic growth that could have cut it much further.

Republicans have since taken to harping on “debt, debt debt” they themselves mainly created, with unpaid-for tax cuts to the wealthy, two wars, and a Medicare “drug benefit” that mainly went to big drug companies. The result is a Grecian austerity that has cut the annual deficit by more than half, but at the expense of economic growth that could have cut it much further.

In all this economic sabotage they've been cheered-on by the Austrians, whose “freedom” is just another word for nothing left to lose and whose “peace” is merely militarism that's the peace of the grave.

As a result 2014 should be a key year. If removing the taper leads to economic collapse, if it proves impossible to rein-in the money supply as the strike ends, if we get hyper-inflation and another depression, then the Austrians are right and they may yet get their dictatorship. If it doesn't the Austrians should slink away.

But that's not the way to bet. If proven wrong in 2014, the Austrians will predict doom in 2015, then 2016, until some new recession “proves” them right. That's how ideologues roll.

My own guess is that the economy will muddle through. We have too much economic strength, from fracking, from the Internet, and from renewable energy, to fail now. It's driven by the incredible innovation emerging from the mass use of cloud computing by scientists and engineers. The next recession starts when today's innovations cause energy prices to fall in response to lower costs.

My own guess is that the economy will muddle through. We have too much economic strength, from fracking, from the Internet, and from renewable energy, to fail now. It's driven by the incredible innovation emerging from the mass use of cloud computing by scientists and engineers. The next recession starts when today's innovations cause energy prices to fall in response to lower costs.

Despite continuing austerity, despite all the economic sabotage the Austrians have advocated through their economic religion, America is moving forward because that's the kind of people we are. We're the free minds of every country, the best-and-brightest from China, from India, from eastern Europe, Africa and Latin America, all lucky enough to have a chance to do our thing, with the real freedom, real peace and real incentives needed to turn our ideas into a better future.