Think of this as Volume 18, Number 5 of the newsletter I have written weekly since March, 1997. Enjoy.

Solar bears are cheering news that renewable energy subsidies are ending.

Solar bears are cheering news that renewable energy subsidies are ending.

In fact, investment in renewable projects is down from its peak. But absolute dollars don’t tell the whole story

The fact is, lower costs for solar and wind mean you get more bang for your buck. You can add more power to the grid with $1 today than you could yesterday, or the day before.

More important, you don’t need subsidies to make the investment any more. Solar and wind are becoming cost-competitive with coal and natural gas in the developed world, and they’re incredible values elsewhere.

What’s really happening on the grid is an investment transition, not a pause. That’s because the “issue” of storage is becoming an enormous opportunity. The Department of Energy wants 100 watts of on-grid storage for every 500 watts of available power. This isn’t just because wind and solar energy are intermittent. It’s also because today’s electronics require far more reliable, constant power than the machines of yesterday. When electricity goes out to a 3-D printer a whole day’s work can be lost. When it’s lost to a cloud computing center the cloud goes down.

What’s really happening on the grid is an investment transition, not a pause. That’s because the “issue” of storage is becoming an enormous opportunity. The Department of Energy wants 100 watts of on-grid storage for every 500 watts of available power. This isn’t just because wind and solar energy are intermittent. It’s also because today’s electronics require far more reliable, constant power than the machines of yesterday. When electricity goes out to a 3-D printer a whole day’s work can be lost. When it’s lost to a cloud computing center the cloud goes down.

So all cloud installations today are built with energy certainty, and storage, in mind. Increasing storage, and adding data sensors to the grid, making it more intelligent, transform the grid from one giant suck to millions of little potential sucks. We need no longer fear terrorists taking down the grid, if power supplies are dispersed, if storage is everywhere, and if intelligence helps the grid repair itself.

Another important point is that, in developing markets like the U.S., electricity demand is no longer rising. That’s all due to the cheapest form of renewable energy, efficiency, making its presence felt. As homes and factories add insulation, they reduce their need for electricity. As we replace incandescent bulbs with LEDs, and as those LEDs in turn are networked so they go on only when needed, demand is reduced further. Each low-efficiency generator replaced with a higher-efficiency one from GE, each low-efficiency heating system replaced with a higher-efficiency one, increases supply and reduces demand. Every high mileage car and truck put on the road reduces demand, producing cheap renewable energy in the form of efficiency. The same is true when you replace a desktop PC with a laptop, or a laptop with a device like the iPad.

Another important point is that, in developing markets like the U.S., electricity demand is no longer rising. That’s all due to the cheapest form of renewable energy, efficiency, making its presence felt. As homes and factories add insulation, they reduce their need for electricity. As we replace incandescent bulbs with LEDs, and as those LEDs in turn are networked so they go on only when needed, demand is reduced further. Each low-efficiency generator replaced with a higher-efficiency one from GE, each low-efficiency heating system replaced with a higher-efficiency one, increases supply and reduces demand. Every high mileage car and truck put on the road reduces demand, producing cheap renewable energy in the form of efficiency. The same is true when you replace a desktop PC with a laptop, or a laptop with a device like the iPad.

What utilities think they’re doing by trying to tax residential solar is kill it, but they’re actually creating new incentives for storing power. The batteries of a Tesla electric car, once they’re replaced, still retain 80% of their charge-carrying capacity. SolarCity can re-sell these battery packs to residential solar owners, and finance them, recycling the batteries and providing additional storage. Even if utilities refuse to link to this storage, homeowners can use it to further reduce their own grid dependence, or to charge up their own electric cars.

What utilities think they’re doing by trying to tax residential solar is kill it, but they’re actually creating new incentives for storing power. The batteries of a Tesla electric car, once they’re replaced, still retain 80% of their charge-carrying capacity. SolarCity can re-sell these battery packs to residential solar owners, and finance them, recycling the batteries and providing additional storage. Even if utilities refuse to link to this storage, homeowners can use it to further reduce their own grid dependence, or to charge up their own electric cars.

In addition to the boom in storage, new private capital is coming to the renewable space. SolarCity has learned how to tap the private markets for its customers, and other companies are bound to follow its lead. A slower-growth market keeps the pressure on suppliers to reduce costs, while retaining the incentives for entrepreneurs to bring real breakthroughs to the market.

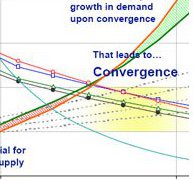

What we’re seeing is a pause, and a transition, to a far more sustainable renewable energy market, based on real costs and private financing. As costs continue to decline, and these private efforts gain more steam, growth will return to the market, but this time competitors won’t be able to force it out.

None of the people following the renewable energy industries are really tracking these developments, in my view. Between them the unsubsidized renewable sector, the storage boom, and the efficiency boom are transforming the supply-demand equation.

Within a few years, probably around 2017, developed markets like the U.S. are going to find themselves in a curious situation. They’re going to be producing more energy tha  n their markets demand. High-cost supplies are going to have to be jettisoned, permanently, in favor of lower-cost supplies.

n their markets demand. High-cost supplies are going to have to be jettisoned, permanently, in favor of lower-cost supplies.

This will cause a recession in the U.S., because our fossil fuel industries are going to take the brunt of this hit. Fracking that now looks like a gold mine won’t play out so much as it will be supplanted by cheaper fracked supplies elsewhere, and new “elephant” finds in South America, Africa and elsewhere. Export markets for natural gas will begin to dry up, as exporting $4/mcf natgas results in supplies that must be priced at $11/mcf to make a profit, and new supplies will be found. Canada is going to crash because its “tar sands” make no economic sense in this new energy world.

The direction of renewable costs, driven by what some consider a recession now, is going to stand the sector in very good stead when this real recession happens. Again, renewable costs are going down, and they will continue to go down, while costs for fracking, for nuclear power, and for coal will inevitably go up. Prices have already achieved crossover, but what we’re going to see soon is cost crossover.

That will mean a short-term recession for the whole country, but much better times ahead as we adapt to a new era of energy abundance, driven by renewable energy.

the future is in solar

the future is in solar

Thank you for this post about solar. Its really a informative post.

Thank you for this post about solar. Its really a informative post.