The 1981 Game

A Non-Standard Story of Solar Shingles

At the truncated Consumer Electronics Show (CES) in Las Vegas this year, a game-changing solar shingle finally debuted. Its story...

Read more2022: Look Around, Look Around

We don’t have to sleepwalk into communism, into fascism, or into Civil War. We are the ones we have been...

Read more2021: Intensive Care

As we approach 2022, we can choose to be happy and choose to care about one another. That’s the only...

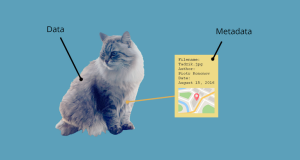

Read moreControlling Data for Good

He who has the data rules, and data is most powerful when part of a system.

Read moreThe Creativity Economy

Fascism of all types is a top-down system that only rewards obedience. That’s its strength because this draws followers who...

Read moreThe Bresch File

Is this hardball? You betcha. Is there a risk? Manchin could storm out of the room, maybe even change parties....

Read moreWill Rogers Was Right

If Democrats just sold a positive message, if they encouraged tech investments in media and showed how Republican actions degrade...

Read moreThe Past is a Sad Country

Everyone wants more, and prosperity doesn’t change it. We all think it was better back then, that it’s all terrible...

Read moreThe Inflation Scare

The Chamber of Commerce can see a direct benefit from investing in roads and bridges. They can’t see it from...

Read morePeople Aren’t Stupid

If we’ve all taken a step back from political action lately, it’s because we’re not stupid. We refuse to be...

Read more