solar energy

Are We the Baddies?

I love America. I love democracy. I love freedom and capitalism. The biggest lie conservatives tell is to deny this...

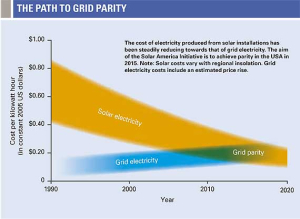

Read moreMoore’s Law of Renewable Energy

I have been covering renewable energy since 2010. One thing I know for certain is that equipment suppliers haven’t made...

Read moreLean Into $100 Oil

You will notice that the oil journal oilprice.com isn’t spooked by the latest Saud move on oil prices and is featuring...

Read moreFood Riots

Maybe hundreds of millions are going to die horrible, premature deaths because oil oligarchs ignored the climate crisis. Some of...

Read moreThe Time Is Now

Now is a great time to listen. Listen to customers, listen to competitors, listen to investors. They will tell you...

Read moreOil is Crack

The current crisis is a temporary one. It’s important that, as businesspeople, as consumers, and as voters, we understand that.

Read moreThe Three Big Challenges Boiled Into One

Systems and standards must be managed. It’s a slow, bureaucratic process. But engineering systems that save money, and sharing the...

Read moreThe Last Dance for Oil and Gas

The fall of oil will be as sudden, as catastrophic, indeed as violent as its rise has been. Autocrats don’t...

Read moreDawn is Coming

Once Putin’s War is over, everything’s going up.

Read moreThe Electric Car Bowl

The next oil crash will be the last one.

Read more