One thing he’s free to say now is that America deserves a raise, because it does. So-called Wall Street “analysts,” with their 8-figure incomes, love to bemoan “wage pressures” on the economy, as though that’s the worst thing that could possibly happen. But America has been under wage pressure for years, from the wealthy, and the economy has done fine.

The great historic achievement of this President, history will record, is what he has done for the rich. While the percentage of national income held by the rich fell sharply during the Great Depression, and in fact fell after every panic before that, it has recovered completely since the Great Recession, which this President solved through stimulus and an activist Federal Reserve. This President kept the rich from poverty

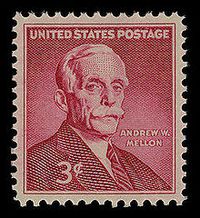

The problem of demand is a global one because no country besides the U.S. has done much to stimulate it since 2008. Jim Cramer of CNBC and my former boss at TheStreet.Com now calls German chancellor Angela Merkel “Hoover in a pants suit.” That’s unfair to Hoover, who did try to address the Depression with things like the Reconstruction Finance Corp. The better historical analogy is to Andrew Mellon, Hoover’s Treasury Secretary, who advised him to “liquidate” labor, stocks, farmers and real estate to “purge the rottenness out of the system.” This advice remains at the heart of the Austrian School of Economics, which proved itself a failure in Europe during the Depression, was exiled to America, and once again proved itself a failure in our time.

This is powerful religion, powerful morality, but history has shown it to be shamefully stupid economics. Government is not a business, and it’s not a family. Government is a bank. For government, deposits are liabilities and loans are assets. Writing down bad loans is part of your business, and taking out new loans – borrowing money – is how you build your asset base. It doesn’t matter whether the budget is balanced. What matters is that the loans you have are sustainable, that you can pay the principal and interest in a timely manner, and that not too many loans go bust. Banking in that way is a little like gardening. If you’re not killing things you’re just a conservationist. Gardening requires regular weeding.

The world is in a deflationary spiral, and it will lead to another Depression unless something is done to stimulate demand. You won’t get that demand by giving money to bankers, or to rich people. They want a return, not cash. You get it by creating demand, by giving money to ordinary people, or offering people valuable work, so they can buy goods and services from one another.

This is the great lesson of the 1930s. Hitler used demand to build a vast military machine and plunge the world into an abyss. America used demand to build the great dams, a highway network, parks, schools and libraries. Fortunately, we won the war.

Of course, the President isn’t in this alone. You’re in it too. So am I. This is the year to start refusing work that’s demeaning, work that doesn’t pay, and work that doesn’t pay enough. This is the year for all people who work for a living to get up on their hind legs and say it.

America deserves a raise. I deserve a raise. You deserve a raise. So do the patriotic thing in 2015. Demand a raise.